In today’s fast-paced world, managing personal finances can be a daunting task. Enter Rocket Money, a budgeting app designed to simplify your financial life and empower you to achieve your financial goals. In this Rocket Money review 2024, we’ll dive deep into its features, analyze its strengths and weaknesses, and explore how it stacks up against other popular budgeting apps. Are you ready to take control of your finances? Let’s get started!

Table of Contents

Key Takeaways

Rocket Money is a comprehensive budgeting app with user-friendly features and two plans: Lite (free) and Premium ($3-$12/month).

It provides users with secure access to financial accounts, budgeting tools, transaction management features, Smart Savings automation & more.

Comparing Rocket Money to other apps can help determine which best suits individual needs & goals. There are monthly fees for premium services.

Rocket Money Overview

Rocket Money is a comprehensive budgeting app developed by Rocket Companies, offering a multitude of features designed to help you manage your personal finances effectively. With Rocket Money, you can:

Negotiate bills to potentially save money

Manage your subscriptions and cancel unwanted ones

Track your income and expenses

Set budget goals and track your progress

Receive personalized financial insights and recommendations

Rocket Money offers both Lite (rocket money free) and rocket money premium plans on their rocket money website, catering to a variety of users with different financial needs.

Users have found Rocket Money to be a legitimate budgeting app with a 4.4 out of 5 stars rating on the Apple store. In this rocket money review, we will discuss the app’s features, such as:

A user-friendly interface

The ability to connect their financial accounts

The ability to manage budgets

The ability to monitor transactions with ease

How Rocket Money Works

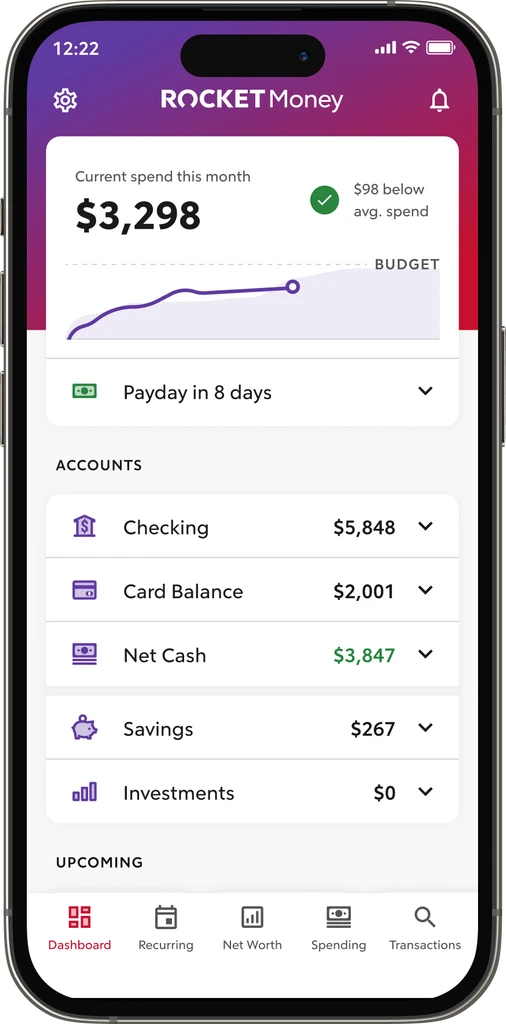

When users log in to the Rocket Money app, they receive a detailed financial snapshot, including current month’s total spending, account balances, and forthcoming bills. The app’s user-friendly interface sets it apart from other personal finance apps, making it a top choice as a personal finance app.

One of the key features of Rocket Money is the Smart Saving feature, which allows users to set specific savings goals or simply set money aside. However, it’s worth noting that some users have reported occasional performance issues with the mobile app.

Connecting Accounts

Rocket Money uses Plaid, a third-party service, to securely link users’ banking, credit card, and investment accounts, offering a comprehensive view of their finances. Plaid’s read-only access ensures that sensitive details are not stored, offering an added layer of privacy for users.

Once connected, Rocket Money updates bank account balances daily upon initial login, ensuring users stay informed about their financial status.

Managing Budgets and Transactions

Rocket Money furnishes users with a variety of budgeting tools and transaction management features, designed to help them maintain control over their personal finances. The app enables users to create distinct budget categories for their expenditures and automatically categorizes most transactions, requiring minimal ongoing maintenance.

Additionally, Rocket Money’s Recurring tab calendar offers an overview of all regular bills and recurring payments, making it easy for users to track payment recipients and due dates.

Rocket Money Plans: Lite vs. Premium

Rocket Money has two plans to accommodate various user needs: the free Lite plan, and the Premium plan, priced between $3 to $12 monthly, depending on the chosen features.

The Lite plan provides basic budgeting tools and account tracking, making it suitable for users seeking a simple financial management solution.

The Premium plan, on the other hand, offers additional features such as unlimited budget categories, shared accounts, and advanced subscription management tools, providing a more comprehensive experience for users who require a higher level of functionality.

Lite Plan Features

The Lite plan, aimed at users looking for a simple financial management solution, offers basic budgeting tools, account tracking, and restricted categories. While the free version of Rocket Money provides essential features such as account linking and standard budgeting, it does come with some restrictions.

For instance, Lite users can create a maximum of only two budgeting rules and do not have access to custom categories for budgeting, which are available exclusively on the Premium plan.

Premium Plan Perks

For users who require enhanced functionality and features, the Premium plan provides a range of additional benefits. Some of these perks include unlimited budget categories, the ability to budget collaboratively with shared accounts, and advanced subscription management tools.

Moreover, Premium subscribers can take advantage of Rocket Money’s Smart Savings feature to automate their savings goals through a savings account. However, it’s important to note that even Premium users have to pay extra for the Bill Negotiation feature, which is charged as a percentage of the first year’s savings, ranging from 30% to 60%.

Saving Money with Rocket Money

Rocket Money’s design helps users save money through the identification and cancellation of unwanted subscriptions, tracking of free trials, and negotiation of lower bills for selected services. The app’s subscription management feature makes it easy for users to spot which services they use regularly and which ones they can live without. For those who opt for the Premium plan, the app even offers the capability to cancel subscriptions on the user’s behalf, saving valuable time and effort.

Moreover, Rocket Money’s Bill Negotiation service provides users with the opportunity to negotiate better rates on their cellphone, cable, and other bills, potentially saving a significant amount of money across multiple bank accounts. However, this service comes with an upfront fee based on the estimated first year’s savings.

Investment Tracking and Net Worth Monitoring

Rocket Money equips users with elementary investment tracking and net worth monitoring features, making it more suitable for casual, rather than serious, investors. The app offers users an overview of their investment accounts and overall net worth, but lacks the advanced tracking capabilities and additional features found in other tools such as Quicken and Empower Personal Dashboard.

In summary, while Rocket Money’s investment tracking and net worth monitoring capabilities are useful for those with casual investment interests, users seeking more comprehensive tracking and tools for retirement planning may want to explore other alternatives.

Rocket Money’s Security Measures

In today’s digital age, the security of one’s financial information is of utmost importance. Rocket Money takes user security seriously, employing the following measures:

Bank-level 256-bit encryption

Industry protocols for data storage

Utilization of Plaid to securely connect to financial institutions without storing users’ online banking credentials

Rocket Money also maintains strict privacy standards and does not sell personal information. However, users should be aware that they may receive offers from other Rocket companies and third-party affiliates.

Overall, Rocket Money Safe is a secure and dependable platform for monitoring banking activities, minimizing expenses, and monitoring credit score as well as obtaining your credit report.

For more info, visit Is Rocket Money Safe to Use?

Comparing Alternatives to Rocket Money

Although Rocket Money provides an extensive array of features for personal finance management, considering alternatives is crucial for making an informed decision. Some popular alternatives include Mint and Simplifi by Quicken, which also offer budgeting tools and credit score monitoring at no cost.

Another option for users seeking more investment-focused features is Personal Capital, which prioritizes long-term investments and provides advanced tracking capabilities and retirement planning tools. By comparing Rocket Money to these alternatives, users can determine the best fit for their specific financial needs and goals.

Pros and Cons of Rocket Money

As with any financial management tool, Rocket Money presents both advantages and disadvantages. Among its advantages are:

The ability to monitor banking account transactions

Track credit scores

Negotiate bills

Providing a range of free personal finance management features

However, the app also has its drawbacks, including:

A monthly fee for premium services

An upfront fee of at least 30% of the annual savings for the Bill Negotiation feature

Potentially high fees and charges.

Taking these pros and cons into consideration, users must weigh their financial needs and preferences before deciding whether Rocket Money is the right choice for them.

Summary

In conclusion, Rocket Money is a versatile budgeting app designed to help users manage their personal finances with ease. With features such as bill negotiation, subscription management, and financial tracking, Rocket Money can be a valuable tool for individuals seeking greater control over their financial lives. However, as with any financial management app, it’s essential to consider alternatives and weigh the pros and cons before making a decision. Ultimately, the choice will depend on your unique financial needs and goals. So, are you ready to take charge of your financial future? Give Rocket Money a try and see if it’s the right fit for you.

Frequently Asked Questions

Does Rocket Money really work?

Rocket Money is a legitimate app designed to help you stay on top of monthly subscriptions and bills. It links your financial accounts and allows you to negotiate better rates if needed. Reports show that the subscription cancellation feature often works as intended.

How much does Rocket Money cost?

Rocket Money costs between $3 and $12 per month, depending on which optional services you opt in for. Its “pay-what-is-fair” model allows you to choose the amount you pay each month, with lower amounts requiring an annual payment.

Why is Rocket Money charging me?

Rocket Money is charging you for a Premium membership, either monthly or annually. You can cancel at any time and find instructions on how to do so in the app.

What is better rocket Money or mint?

When comparing Rocket Money (Truebill) and Mint, it’s clear that Mint offers more free services while Rocket Money has additional money management tools. If you’re looking for a free budgeting app to create custom categories for a budget, you’ll need Rocket Money’s Premium plan. On the other hand, if you need help managing your spending habits and financial accounts, using Mint to create monthly budgets is a great option.

What is Rocket Money’s Lite plan?

Rocket Money’s Lite plan is a free version offering budgeting tools, account tracking and limited categories to help users manage their finances with simplicity.